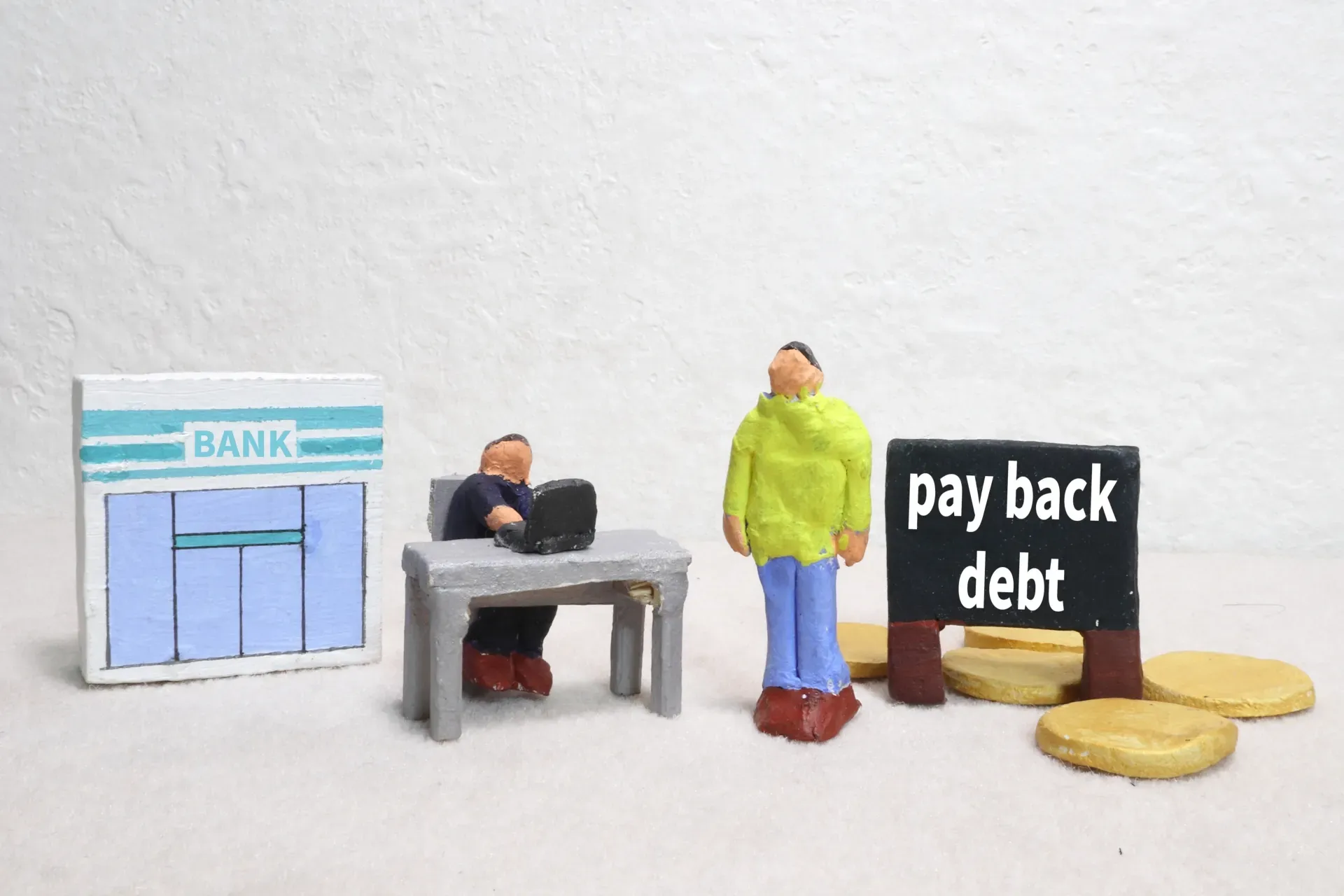

In recent years, the increase in personal debt, including student loans and medical expenses, has become a serious social problem in the U.S. As of December 2023, the total personal debt of Americans exceeded $16 trillion, an all-time high. In response to this situation, the government and private organizations offer a variety of debt relief programs, but the types and details of these programs are complex and finding the best program is not easy.

The Current State of the U.S. Debt Problem

In the United States, personal debt has skyrocketed due to rising college enrollment rates and rising health care costs. Student loans, in particular, have reached an average of approximately $30,000 and are a major burden for many young people. In addition, an increasing number of people are struggling with their ability to pay medical bills, and delinquent payment of medical expenses has become a social problem.

Types of debt relief programs

There are two main types of debt relief programs in the United States: government and private programs.

Government program

Student Loan Repayment Assistance Programs

These are government programs that help students repay their student loans. There are a variety of types of programs, including income-linked repayment plans and debt forgiveness programs.

Low Income Health Care Assistance Programs

These are health care assistance programs for low-income individuals. Programs such as Medicaid and Medicare are available.

Private Programs

Debt Consolidation

A program that reduces debt or establishes a repayment plan with the help of a lawyer or professional organization.

Consolidation Loan

A program that reduces the burden of repayment by consolidating multiple debts into a single loan.

How to Choose the Best Debt Relief Program

In order to choose the debt relief program that is best for you, you need to consider the following.

Current Debt Status

You need to know the type, amount, and repayment status of your debt.

Income and Expenses

You need to know your monthly income and expenses and calculate the amount you can afford to repay.

Future Goals: You need to identify how much you want to reduce your debt to meet your future goals.

Advantages and disadvantages of each program

Government program

Advantages

Lower interest rates, longer repayment terms, etc.

Disadvantages

Strict application requirements; may not be approved.

Private Programs

Advantages

relatively loose application requirements and immediate availability.

Disadvantages

Fees can be expensive.

Summary

There are advantages and disadvantages to each type of debt relief program in the United States. In order to choose the best program for you, it is important to understand your own situation and compare each program.